Why do people fall prey to scams

Why do people fall prey to scams?

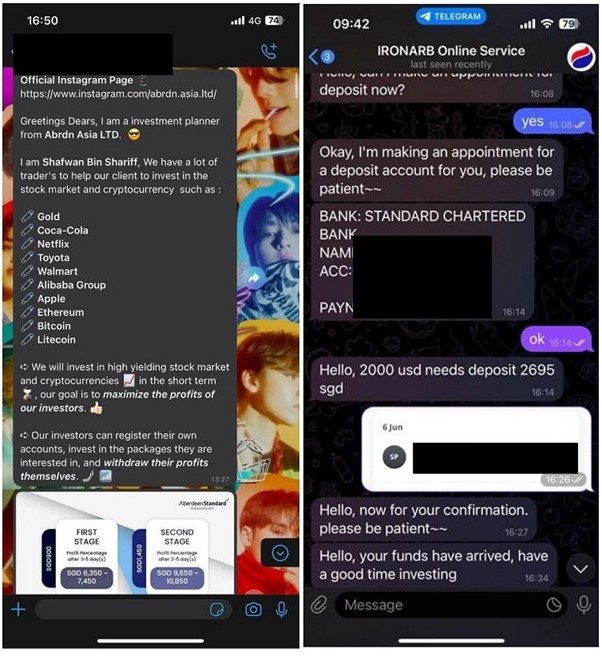

Consider this scenario! You were added into an exclusive investment group on Telegram by someone who claims to be an investment planner from a company advertising their investment services in the stock market and cryptocurrencies. By following their instructions, you can receive quick attractive profits!

What was it that made you engage? Why did you not check before you responded?

Anyone can fall prey to scams! This is clear from our crime statistics. There are, however, some amongst us, who think that they would never fall prey and/or are not concerned about scams. A common contributing factor to this mindset is our high internet exposure and connectivity levels. The 2023 IMDA digital society report revealed 99% of households in Singapore are connected to the Internet, 97% of residents have smartphones and 93% regularly enjoy the convenience afforded by digital technology.

The convenience to engage in a myriad of innocuous activities online – communicating with others, e-commerce, banking etc – are also those targeted by scammers. As Singaporeans become more digitally savvy, some of us may develop a feeling of overconfidence after becoming familiar with navigating the online space and having avoided falling prey to scams to date. Some of us may also think that we might not be the typical profile of victims targeted by scammers – a common stereotype being the elderly. Given that scams are ever evolving and pervasive, and scammers target our human vulnerabilities and use our own emotions and desires (e.g., fear and greed) against us – our familiarity with the online space and knowledge of several scam types can only go so far.

Psychology of deception and social engineering

We tend to underestimate the diverse and sophisticated tactics used by scammers. Scam scenarios are skilfully designed to catch victims off guard and exploit moments when our defences are down. Scammers tend to create a heighten state of emotion (e.g. fear, excitement) in their approaches. When we are in a heightened state of emotion (i.e., psychologically ‘hot’ state), we are less able to think critically and scrutinize the situation we are facing in detail. Consequently, we make poorer decisions, and this makes us more susceptible to scammers’ schemes.

Scammers also use effective influence tactics that targets our basic needs and tendencies. For example, we tend to trust authority figures, return a favour when people help us, comply to demands made in rare situations (e.g., a limited time offer, emergency loan requests from friends), like people who flatter us and share similarities, and our decision making is often influenced by the majority.

Common influence tactics used by scammers (Cialdini, 1984, 2007) |

|

|

1. Commitment & Consistency: Scammers make small requests to establish commitment in their victims to induce complicity with larger demands in the future. |

Asked to do simple tasks like reacting to social media accounts/posts to get small commissions and later invited to engage in more “rewarding” tasks to get larger commissions? |

|

2. Authority: Scammers pose as knowledgeable experts to build credibility and trust with their victims. |

Received a message allegedly from the government accusing you of committing an offence and threatening you with legal consequences if you do not comply? |

|

3. Reciprocity: Scammers act helpful to make their victims obligated to “repay” those favours. |

Encountered an unknown investment planner willing to offer you trial credits to try investing? |

|

4. Liking: Scammers act concerned about their victims, give compliments, or share similar interests to build rapport. |

Engaged with a stranger who quickly ingratiated himself/herself to you by being overly concerned and sensitive to your needs? |

|

5. Consensus/Social Proof: Scammers pretend others are involved in an activity to make it seem normal since “everyone else is also doing it” to get their victims to conform. |

Added into an “investment” Telegram group with strangers gushing positive feedback about earning big returns quickly? |

|

6. Scarcity: Scammers don't give people time to consider by emphasizing urgency and limited stock. |

Found a post highlighting a limited time-only deal or promotion on Facebook that you could not find elsewhere? |

Multiple protective actions needed to enhance our scam resilience.

We lock the doors to our homes even though crime rates are low, and we generally feel safe in Singapore. We also wear seatbelts when we drive, even though some amongst us may think that they are good drivers. Such behaviours are almost second nature to us and serve to enhance our resilience against the risks inherent in those respective contexts.

Given the design of scams and scammers’ sophisticated tactics, mere familiarity with the online space and awareness of scams are insufficient. We need to change our mindsets regarding our vulnerability to scams. A recent survey by the Singapore Police Force shows that individuals who acknowledge their vulnerability tend to keep themselves up to date regarding the latest scam trends and adopt more protective measures.

Apart from changing our mindset, we will also need to proactively adopt protective measures to strengthen our resilience against scams. The adoption of these behaviours must be second nature, and such behaviours serve to reduce the likelihood of us falling prey to scams and/or mitigate our financial losses to scams, especially when our defenses are down.

ACT to strengthen your resilience against scams today!

ADD:

-

ScamShield app to block scam calls and filter scam SMSes.

-

Anti-virus app to your devices (List of recommended apps by CSA).

-

Only install apps from official app stores.

-

Money Lock to your bank accounts to further secure a portion of your savings.

-

International Call Blocking option to your mobile account(s).

-

2 or multi-FA to your online accounts

CHECK:

-

With someone you trust about the situation.

-

Call the ScamShield Helpline (1799) to check if you are unsure. You can also check by submitting suspicious phone numbers, messages and weblinks to the ScamShield app.

-

Never disclose your personal information (including NRIC and Singpass), internet banking and social media account details, and one-time passwords (OTPs) to anyone.

-

SMSes from government agencies will use a single gov.sg SMS Sender ID. Every text message will begin with the full name of the agency that sent it and end with a note stating that it is an automated message sent by the Singapore Government.

TELL:

-

Share your scam encounters with authorities via the ScamShield app.

-

Warn friends and family about this scam encounter.

-

Report and block suspected scam accounts/chat groups.

-

Call your bank immediately and make a police report if you think you have fallen victim.

Scams are a bane to our society and an assault on our personal vulnerabilities. Recognising our vulnerabilities is the first step towards taking steps to protect ourselves. To fight back, we need to work on ourselves and build our collective resilience against scams. Together, we can ACT against scams!